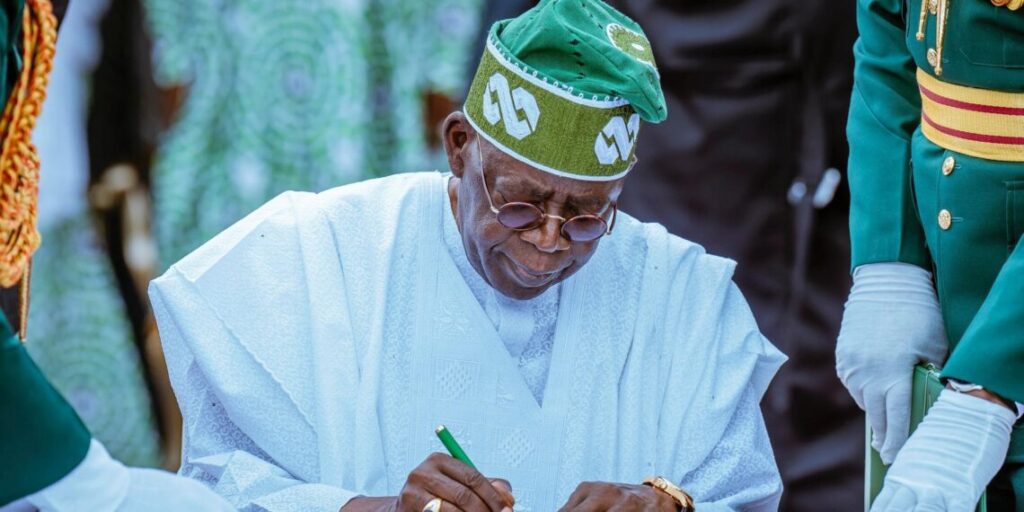

President Bola Ahmed Tinubu has requested the approval of the Senate for a fresh N1.15 trillion domestic loan to finance the 2025 budget deficit and sustain key government programs.

The request was contained in a letter addressed to Senate President Godswill Akpabio and read during plenary on Tuesday.

According to the president, the proposed borrowing is part of the federal government’s fiscal strategy to bridge funding gaps, boost infrastructure investment, stimulate economic growth, and support social welfare initiatives.

Tinubu emphasized that the borrowing will enable the full implementation of critical projects and programs outlined in the 2025 fiscal plan, ensuring continuity and progress in government operations.

Following the letter’s presentation, Senate President Akpabio referred the request to the Senate Committee on Local and Foreign Debt for legislative scrutiny and recommendations. The committee is expected to submit its report within one week, after which the Senate will deliberate on the proposal.

Background and Fiscal Context

The proposed borrowing aligns with the federal government’s fiscal framework, which combines both domestic and external financing to manage revenue shortfalls and sustain ongoing development projects.

Last month, the House of Representatives approved President Tinubu’s request to borrow $2.35 billion to finance part of the 2025 budget deficit. The green chamber also endorsed a $500 million sovereign sukuk issuance in the international capital market (ICM) to support infrastructure development and diversify Nigeria’s funding sources.

In July 2025, the Senate approved a $21.5 billion external borrowing plan covering 2025–2026, along with a N757 billion Federal Government Bond to clear accrued rights under the Contributory Pension Scheme (CPS) as of December 2023.

According to the Debt Management Office (DMO), Nigeria’s total public debt rose to N149.39 trillion as of March 31, 2025 — a 22.8% year-on-year increase from N121.67 trillion recorded in the same period of 2024.

The DMO also disclosed that it successfully raised N1.39 trillion through domestic Sukuk bonds, which have been directed toward the construction and rehabilitation of major roads and bridges nationwide.

Implications of the Loan Request

President Tinubu’s fresh request for a N1.15 trillion domestic loan underscores the administration’s reliance on borrowing to fund national priorities amid persistent revenue shortfalls.

While this approach supports continued government spending on infrastructure and social programs, analysts warn that it could further inflate Nigeria’s debt burden and raise concerns about future repayment obligations.

However, fiscal experts note that domestic borrowing carries certain advantages: it reduces foreign exchange risks, deepens the local capital market, and provides liquidity opportunities for institutional investors.

As Nigeria continues to pursue fiscal consolidation and economic reforms, attention will remain on how effectively the government manages its rising debt while balancing growth and financial stability.