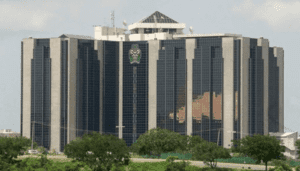

CBN Injects $197.71 Million into FX Market to Boost Naira Liquidity

Central Bank of Nigeria (CBN) injects $197.71 million into the foreign exchange market to stabilise the naira, enhance liquidity, and counter global economic shifts

Central Bank of Nigeria (CBN) injects $197.71 million into the foreign exchange market to stabilise the naira, enhance liquidity, and counter global economic shifts

The naira struggles below ₦1,550/$ in the parallel market despite growing FX reserves. Meanwhile, global markets await President Trump’s new tariff plans.

Naira has seen depreciation following the Trans-Niger Pipeline (TNP) explosion and the political tensions in Rivers State.

The Naira gained 8.5% on the parallel market in February 2025, closing at ₦1,490/$ as the CBN’s forex interventions bolstered the currency

CBN inflation control strategy aims to bring inflation rate down to a single-digit level as CBN Governor reaffirmed the MPC meeting decision

Nigeria’s foreign exchange reserves fell by $832.62 million between January 6 and January 21, 2025, highlighting growing macroeconomic challenges

CBN calls on business-minded Nigerians to take advantage of the export potentials unlocked by the weakened naira.

Central Bank of Nigeria (CBN) tightens forex management, mandating 90- and 180-day deadlines for export earnings repatriation without extensions.

FirstBank Group CEO, Olusegun Alebiosu expresses confidence that the 2025 budget will offer stimulation to the Nigerian economy

Nigeria’s Broad Money Supply (M2) rose by 51% year-on-year to ₦108.95 trillion in November 2024, driven by increased domestic borrowing by the Federal Government.

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Websites store cookies to enhance functionality and personalise your experience. You can manage your preferences, but blocking some cookies may impact site performance and services.

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy.