CBN Targets Single-Digit Inflation as MPC Maintains Interest Rate at 27.5%

CBN inflation control strategy aims to bring inflation rate down to a single-digit level as CBN Governor reaffirmed the MPC meeting decision

CBN inflation control strategy aims to bring inflation rate down to a single-digit level as CBN Governor reaffirmed the MPC meeting decision

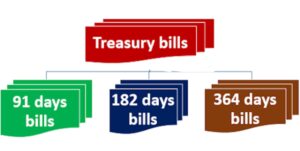

Nigeria’s February 19 Treasury Bills auction attracts N2.41 trillion in subscriptions, indicating an unshaken investor confidence.

CBN has issued a directive requiring banks and financial institutions to publish dormant accounts and unclaimed balances on their websites.

Nigeria’s inflation rate drops to 24.48% in January 2025, down from 34.80% in December 2024, following the rebasing of the Consumer Price Index (CPI)

CBN Governor Olayemi Cardoso emphasizes Nigeria’s commitment to digital financial inclusion, highlighting mobile money services

Nigeria’s Monetary Policy Committee will hold its first 2025 meeting on Feb 19–20, with analysts predicting no changes to the MPR

Central Bank of Nigeria (CBN) reassures the public of Keystone Bank safety following a court order granting the federal government takeover.

Nigeria’s Purchasing Managers’ Index (PMI) hit 52.0 in January 2025, signaling continued growth despite a minor slowdown

Nigerian local governments must submit two-year audit reports to the CBN before receiving direct FAAC allocations

The IMF and World Bank have emphasized the importance of the CBN efforts to control inflation as Nigeria’s inflation rose to 34.8%

We use cookies to improve your experience on our site. By using our site, you consent to cookies.

Websites store cookies to enhance functionality and personalise your experience. You can manage your preferences, but blocking some cookies may impact site performance and services.

Essential cookies enable basic functions and are necessary for the proper function of the website.

These cookies are needed for adding comments on this website.

Statistics cookies collect information anonymously. This information helps us understand how visitors use our website.

Google Analytics is a powerful tool that tracks and analyzes website traffic for informed marketing decisions.

Service URL: policies.google.com (opens in a new window)

You can find more information in our Cookie Policy and Privacy Policy.