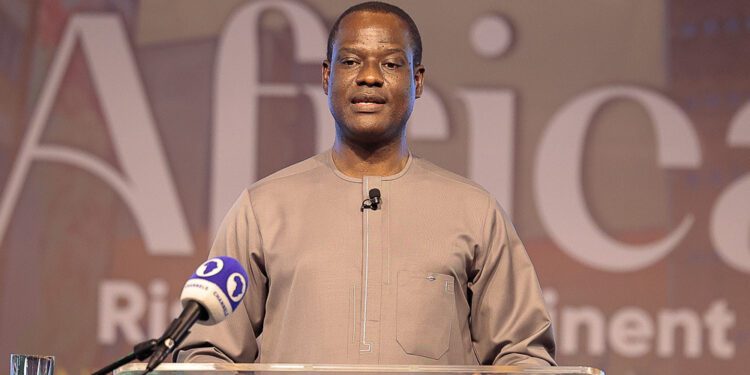

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has refuted claims that foreign investors expressed frustration during his recent virtual engagement on Nigeria’s new Capital Gains Tax (CGT) policy, insisting that feedback from participants rated the session highly.

Oyedele, in a post shared on his official X (formerly Twitter) account on Monday, October 17, 2025, stated that about 80% of the 281 participants who attended the call from more than 10 countries scored the engagement 9 or 10 out of 10, with an overall average rating of 8.6.

He said the feedback contradicted reports by Nairametrics suggesting that the meeting left many foreign investors uneasy about the direction of Nigeria’s fiscal policy.

According to Oyedele, “Contrary to claims of frustration and unease, most participants rated the engagement 9 or 10 out of 10, with many wishing we had more time — certainly not the reaction of frustrated investors.”

Responding to criticism that his stance on CGT reflected a socialist ideology, Oyedele clarified that the committee’s focus on taxing the wealthiest 3% of investors was a matter of fairness, not socialism.

“My statement was in the context of low-income earners and nano businesses,” he explained. “Exempting the poor while taxing the wealthy fairly is not socialism; it is progressive taxation a principle embedded in virtually every advanced economy.”

Oyedele also rejected concerns that the new CGT provisions could make Nigeria less competitive in attracting investors, stressing that competitiveness is not determined by the absence of such taxes.

“Competitiveness depends on overall returns and risk factors, not on the absence of CGT,” he said. “The most advanced capital markets — the U.S., U.K., and South Africa apply CGT and still attract investors.”

The reform chief further dismissed media claims, particularly from BusinessDay, alleging that the new policy would triple CGT for foreign equity investors. He clarified that both local and foreign investors would benefit from exemptions tied to reinvestment thresholds, and the tax would only apply when profits exceed those limits without reinvestment.

Oyedele emphasized that foreign investors are generally taxable in their home countries, and where they are not, it is fair for the source country — Nigeria — to collect its share of taxes. He also noted that other leading African markets like South Africa, Morocco, Botswana, and Egypt already apply tax on shares, making Nigeria’s approach consistent with global standards.

Nairametrics had earlier reported that many foreign investors left Oyedele’s investor call disappointed and uneasy about the direction of Nigeria’s tax reforms. The platform claimed that several participants found Oyedele’s tone “ideological” and “more socialist than market-oriented.”

However, Oyedele’s latest statement paints a different picture, suggesting that the majority of participants appreciated the engagement and were more interested in continuity and clarity than in criticism.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.