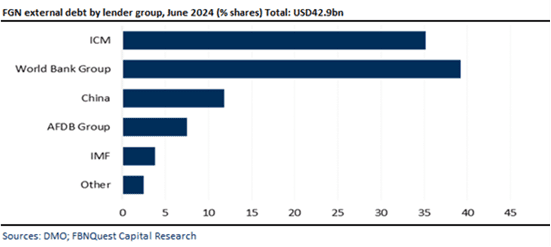

The Debt Management Office (DMO) has released its Q2 2024 public debt report, revealing that Nigeria’s external debt stock rose slightly by +2% quarter-on-quarter (QoQ) to $42.9 billion, while declining by -1% year-on-year (YoY). However, in naira terms, external debt increased significantly, surging +13% QoQ and +90% YoY due to the sharp depreciation of the naira.

Debt Composition and Impact

- The Federal Government of Nigeria (FGN) accounts for 89% of the total external debt, while state governments owe the remaining 11%, guaranteed by the FGN.

- External debt now represents 27.4% of GDP, up from 14.5% in Q2 2023 and 24.4% in Q1 2024, reflecting mounting debt pressure.

- The share of external debt in Nigeria’s total debt stock rose to 47% in Q2 2024, compared to 38% in Q2 2023, highlighting the impact of naira devaluation on dollar-denominated obligations.

Key Contributors to the Debt Increase

- Multilateral loans saw a +4% QoQ rise, adding $799 million to reach $21.6 billion.

- The World Bank led this growth, with its loan increasing by +8% QoQ, or $1.2 billion.

- A minor $28 million increase in debt owed to China also contributed.

- Debt owed to the IMF declined by -21% QoQ ($419 million), with smaller reductions from other bilateral lenders.

Multilateral and Commercial Debt Breakdown

- Multilateral debt forms 50.4% of total external debt, up slightly from 49.5% in Q1 2024.

- Bilateral debt constitutes 13.7%, marginally lower than 14.5% in Q1 2024.

- Commercial debt remained steady at $15.1 billion, reflecting tight global financial conditions.

Future Outlook

With $3.8 billion in newly approved loans from the World Bank and ongoing naira volatility, Nigeria’s external debt burden is expected to rise further. These developments underscore the critical need for prudent debt management strategies as the country navigates fiscal and monetary challenges.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.