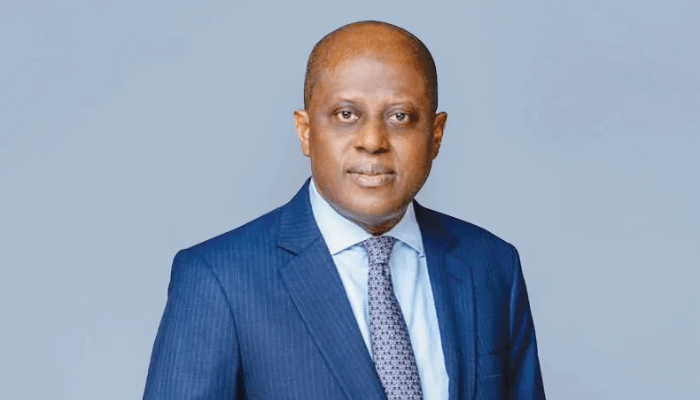

Nigeria recorded a 9% increase in remittance inflows in 2024, reaching $20.98 billion, the highest in five years, according to data from the World Bank. This surge, led by policy reforms under Olayemi Cardoso, Governor of the Central Bank of Nigeria (CBN), marks a significant recovery in external financial flows.

The last time remittance levels crossed the $20 billion mark was in 2019, when Nigeria received $23.80 billion. The peak inflow over the past decade was in 2018 at $24.31 billion, while the lowest came in 2020 at $17.21 billion, amid global economic disruptions.

Personal remittances in 2024 stood at $20.93 billion, up 8.9% from the previous year. A key driver was the robust rise in transfers through International Money Transfer Operators (IMTOs), which jumped by 43.5%, from $3.30 billion in 2023 to $4.73 billion. This reflects growing confidence in formal remittance channels among the Nigerian diaspora.

Official development assistance also rose by 6.2% to $3.37 billion, adding to Nigeria’s improving external financing mix.

Governor Cardoso attributed the gains to ongoing economic reforms, including incentives for formal remittance processing. Monthly remittance inflows, he said, grew from $250 million earlier in the year to $600 million by September 2024.

“More Nigerians abroad are choosing formal channels, thanks to new CBN policies that have made remittance platforms more appealing,” Cardoso explained.

Reserves and Investment Flows Bolster External Accounts

Nigeria’s external reserves expanded by $6.0 billion, closing the year at $40.19 billion, while the country recorded a balance of payments surplus of $6.83 billion a stark reversal from deficits of $3.34 billion in 2023 and $3.32 billion in 2022.

This improvement stemmed from a $17.22 billion surplus in the current and capital account, bolstered by a goods trade surplus of $13.17 billion, stronger export earnings, and disciplined import spending.

Despite these gains, the naira depreciated by 40.9%, ending the year at N1,535/$1, compared to N907.1/$1 in 2023 at the Nigerian Foreign Exchange Market (NFEM). This depreciation came amid the CBN’s unification of exchange rates and liberalisation of the forex market.

Nigeria’s portfolio investment inflows more than doubled in 2024, rising by 106.5% to $13.35 billion, driven by improved macroeconomic stability. Meanwhile, resident foreign currency holdings increased by $5.41 billion, indicating renewed investor confidence.

While foreign direct investment (FDI) declined by 42.3% to $1.08 billion, the overall financial account posted a net asset acquisition of $12.12 billion, underlining the strength of capital inflows.

The CBN’s Monetary Policy Committee (MPC) projects even stronger flows from remittances, FDI, and portfolio investment in the coming year as reforms continue to take hold.

Leading the African Continent

Nigeria remains Africa’s largest remittance recipient, far outpacing countries like Ghana, which received $2.43 billion in 2023, and South Africa, where remittance inflows declined to $803.3 million in the same year.

A major development in 2024 was the reduction in net errors and omissions, which dropped by 79.5% to – $5.10 billion, from – $24.90 billion in 2023. This reflects improved data integrity and reporting standards.

Nigeria also benefited from a 48.3% rise in gas exports ($8.66 billion) and 24.6% growth in non-oil exports ($7.46 billion), while petroleum imports fell by 23.2% and non-oil imports declined by 12.6%.

Analysts believe Nigeria’s current external gains stem from effective fiscal and monetary coordination, exchange rate reforms, and efforts to strengthen diaspora engagement particularly in regions like the Middle East.

Governor Cardoso reaffirmed his commitment to deepening collaboration with Nigerians abroad, boosting remittance channels, and continuing reforms to sustain macroeconomic stability.

“This surplus marks an important step forward for Nigeria’s economy, benefiting investors, businesses, and everyday Nigerians alike,” he said.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.