The first quarter of 2025 has been a defining period for Nigeria’s tier-1 banks, marked by significant shifts in share prices. This movement reflects investor sentiment, earnings strength, and broader economic conditions in the country’s financial sector.

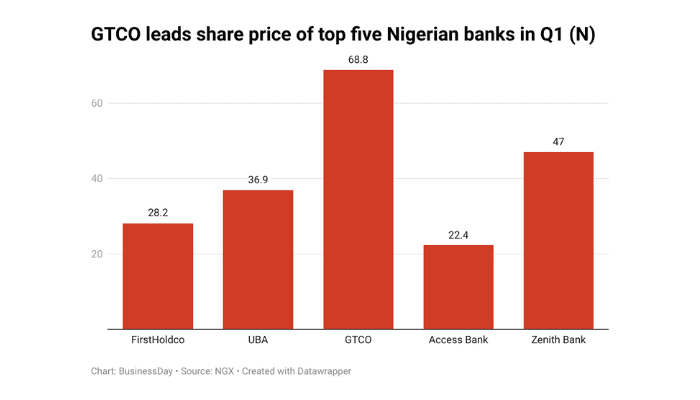

Among the five leading banks First Bank Holding (FirstHoldco), United Bank for Africa (UBA), Guaranty Trust Holding Company (GTCO), Access Bank, and Zenith Bank GTCO emerges as the top-priced stock at ₦68.80, while Access Bank lags behind at ₦22.35.

These changes come after an exceptional 2024 performance, with GTCO and Zenith Bank each reporting over ₦1 trillion in profit-after-tax, solidifying their positions in the market.

GTCO’s ₦68.80 per share valuation makes it the most expensive among its peers, signaling strong investor confidence in its profitability, brand strength, and digital banking expansion. The bank recorded the highest return on equity (ROE) at 37.53%, effectively utilizing shareholders’ funds. GTCO’s strategic investments in fintech and wealth management have attracted both retail and institutional investors.

Following GTCO is Zenith Bank, with a ₦47.00 share price, reinforcing its corporate banking dominance and reputation for strong dividend payouts. Investors favor its balance sheet strength, demonstrating resilience in a volatile economic environment.

UBA’s ₦36.90 share price suggests growing investor confidence, potentially shifting its position among Nigeria’s top banks. The bank’s aggressive African expansion strategy has diversified its revenue base beyond Nigeria. With this momentum, UBA could challenge GTCO and Zenith Bank in market valuation.

While FirstHoldco trades at ₦28.50 and Access Bank at ₦22.35, their relatively lower valuations raise questions. Access Bank, despite being Nigeria’s largest bank by assets, is seeing investor concerns over its aggressive acquisitions and integration risks. For long-term investors, this may present a buying opportunity if the bank successfully translates its expansion into higher earnings. FirstHoldco, formerly First Bank, is in a transition phase, and its valuation may reflect investor caution regarding governance issues or its ability to compete with tech-driven rivals.

Growth investors may find GTCO and Zenith Bank attractive due to their premium pricing and market confidence. Value investors could view Access Bank and FirstHoldco as potential bargains if they execute their strategies effectively. UBA is emerging as a major force, reshaping investor perception and positioning itself as a strong competitor.

As Nigeria’s economy evolves, the share price movements of these banks will continue to serve as a key indicator of investor confidence, operational efficiency, and strategic execution in 2025.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.