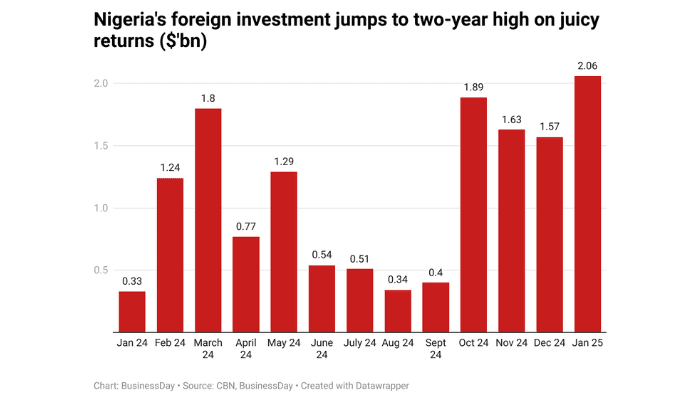

Foreign investment in Nigeria has reached its highest level in over two years, spurred by favorable returns following the Central Bank of Nigeria’s (CBN) aggressive interest rate hikes. According to the CBN’s January 2025 Economic Report, capital inflows soared by over 524%, rising from $0.33 billion in January 2024 to $2.06 billion in the same month of 2025.

The surge reflects growing investor appetite for short-term returns in Nigeria’s domestic financial market, largely due to the central bank’s tight monetary policies. This follows a 32.12% month-on-month rise from $1.57 billion recorded in December 2024.

The 9am News report highlights that most of the capital inflow was in the form of portfolio investment, which constituted 89.60% of the total. In comparison, ‘other investments’ mostly loans accounted for 7.01%, while foreign direct investment (FDI) contributed just 3.39%.

Despite the overall inflow growth, FDI dropped from $0.12 billion in December 2024 to $0.07 billion in January 2025. Experts attribute this to Nigeria’s enduring macroeconomic uncertainty, infrastructural challenges, and security concerns, which continue to deter long-term investors.

Similarly, ‘other investments’ declined to $0.14 billion from $0.22 billion, reflecting investor caution in lending amid rising global economic headwinds.

The banking sector emerged as the top recipient of foreign capital, accounting for 45.22% of total inflows. This was closely followed by the financing sector at 44.32%. Other sectors such as telecommunications (3.86%), production and manufacturing (3.01%), shares (1.57%), and trade (1.43%) also attracted foreign interest, though to a lesser extent.

Top Sources and Destinations of Investment

In terms of origin, the United Kingdom was the leading source of capital inflow, contributing 65.65%. The United States followed with 8.15%, while South Africa (7.66%), UAE (7.18%), Mauritius (2.87%), and Belgium (2.28%) made up a significant portion of the remainder.

The Federal Capital Territory (FCT) received the highest share of inflows at 62.88%, followed by Lagos at 36.59%. Other states, including Ogun and Kano, accounted for minimal shares at 0.04% and 0.01% respectively.

While foreign investments into Nigeria spiked, capital outflows also increased in January 2025, primarily due to heightened loan repayments and capital reversals. The CBN noted that outflows rose to $1.20 billion, up from $1.06 billion the previous month.

Loan repayments accounted for the largest share of capital outflows at 54.33%, followed by capital reversals at 44.81%. Interestingly, repatriation of dividends dropped sharply by 66.67% to $0.01 billion, reflecting either delayed payments or retained earnings due to market uncertainties.

According to Renaissance Capital Africa CEO Samuel Sule, “There has been a partial reversal of foreign flows given the volatility in oil prices. That said, investors continue to acknowledge key fiscal and monetary reforms which have put the sovereign on a better footing.”

CBN’s Orthodox Monetary Policy Yields Results

Under Governor Olayemi Cardoso, the CBN has raised benchmark interest rates by a cumulative 875 basis points to 27.5% in a strategic attempt to tame inflation and attract foreign capital. The policy stance has evidently worked in favor of foreign portfolio inflows, as investors see high-yield opportunities in Nigeria’s fixed income and equities markets.

However, global geopolitical tensions and economic shifts—including reciprocal tariffs introduced during Donald Trump’s tenure—could pose risks to sustained capital inflow.

For now, Nigeria’s investment outlook remains cautiously optimistic, buoyed by reforms and interest rate incentives, but tempered by structural risks and a fragile investor confidence in long-term stability.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.