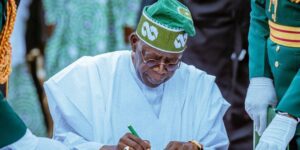

The Federal Government has approved Nigeria’s Medium-Term Debt Management Strategy (MTDS) for 2024–2027, designed to strengthen debt sustainability, enhance fiscal stability, and deepen the domestic securities market.

The Debt Management Office (DMO), in a press release on Saturday, confirmed the endorsement of the framework by the Federal Executive Council (FEC). The MTDS, developed with technical support from the World Bank and International Monetary Fund (IMF), is globally regarded as a best practice for managing public debt.

According to the DMO, the strategy will help balance the Federal Government’s financing needs with debt sustainability considerations, while minimizing borrowing costs and associated risks.

Related Posts

Debt sustainability targets set

The MTDS outlines fresh fiscal and debt benchmarks for the period 2024–2027:

- Debt-to-GDP ratio projected to increase from 52.25% in 2024 to a ceiling of 60% by 2027.

- Interest payments-to-GDP capped at 4.5%, up from 3.75% in 2024.

- Sovereign guarantees-to-GDP limited to 5%, compared to the current 2.09%.

- Domestic-to-external debt mix adjusted from 48:52 to 55:45, reducing FX exposure.

- Refinancing risk contained, with a maximum of 15% debt maturing within one year, and debt maturing as a share of GDP capped at 5%.

- Average time to maturity for public debt portfolio set at a minimum of 10 years.

- FX debt share to be reduced to 45%, down from 51.75%.

The DMO stated that the framework was prepared in consultation with key fiscal and monetary authorities, including the Central Bank of Nigeria (CBN) and the Federal Ministry of Finance, alongside technical inputs from the World Bank and IMF.

What this means for Nigeria

The Federal Government believes the new MTDS will boost investor confidence, improve Nigeria’s credit ratings, and signal fiscal discipline to international partners.

The strategy succeeds the 2020–2023 MTDS, which prioritized domestic borrowing. By extending repayment timelines, adjusting debt composition, and capping foreign exposure, the government aims to safeguard the economy against shocks while meeting funding obligations.

A 9am News report shows that the plan reflects Nigeria’s effort to reassure stakeholders that it is committed to responsible debt management amid rising fiscal pressures.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.