The Central Bank of Nigeria (CBN), in partnership with the Nigeria Inter-Bank Settlement System (NIBSS), has launched a groundbreaking Non-Resident Bank Verification Number (NRBVN) platform that allows Nigerians abroad to obtain their BVNs remotely.

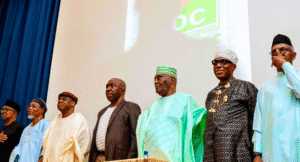

This landmark initiative, unveiled in Abuja, eliminates the need for physical presence in Nigeria and aims to significantly boost diaspora remittances, with projections suggesting inflows could quadruple in the coming months.

According to a 9am News report, CBN Governor Olayemi Cardoso described the platform as a pivotal development in expanding financial access to Nigerians living outside the country.

“For too long, Nigerians abroad have faced difficulties accessing services due to physical verification requirements,” Cardoso said. “The NRBVN changes that through secure digital identity verification and robust KYC processes.”

The NRBVN platform offers a user-friendly digital channel for identity authentication and onboarding into Nigeria’s financial ecosystem. Cardoso emphasized that this is part of a larger plan to build an inclusive financial architecture that spans beyond borders.

“This is not a one-off solution. It’s a step toward a global, efficient, and inclusive system that allows Nigerians, wherever they are, to participate in national development,” he stated.

With over 27 Nigerian banks already integrated into the system, the platform allows diaspora Nigerians to open domiciliary accounts remotely, manage savings, access loans, and invest in Nigeria’s financial markets—without stepping foot in the country.

NIBSS CEO Premier Oiwoh noted that the NRBVN would not only reduce reliance on informal remittance methods but also enhance security, cost-effectiveness, and transparency.

“In parts of London, people still send money through roadside kiosks,” Oiwoh said. “This platform changes that—money can now be remitted directly from a user’s home securely and at a lower cost.”

The new system is expected to contribute significantly toward achieving the CBN’s ambitious target of $1 billion in monthly remittance inflows. From $3.3 billion in 2023, remittances grew to $4.73 billion in 2024, a rise largely attributed to reforms like the “willing buyer, willing seller” foreign exchange policy.

“We are unlocking a major economic lever,” Cardoso added. “This is about national inclusion, innovation, and shared prosperity.”

The NRBVN is built in line with global regulatory standards, incorporating Anti-Money Laundering (AML) controls and Know Your Customer (KYC) procedures. Each enrollment undergoes strict digital verification, minimizing risks such as fraud and identity theft.

The platform complements existing diaspora-targeted instruments like the Non-Resident Ordinary Account (NROA) and the Non-Resident Nigerian Investment Account (NRNIA), allowing access to savings, mortgages, insurance, pensions, and capital markets—all with repatriation rights intact.

Oiwoh concluded that trust and ease of use are central to the system’s success.

“We believe the NRBVN will build confidence and increase formal remittance volumes. It’s about bringing more Nigerians into the financial fold.”

As part of Nigeria’s broader economic reform and digital transformation agenda, the NRBVN platform signals a strategic pivot in how the country engages its global citizens, enhances foreign exchange liquidity, and drives inclusive national growth.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.