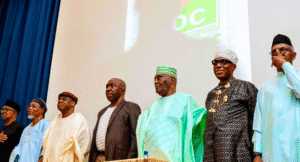

Foreign investors have applauded Nigeria’s recent macroeconomic reforms but warned that key structural challenges must still be addressed for long-term capital inflows to take root. The message came during a high-level investor forum hosted by the Central Bank of Nigeria (CBN) at the Nasdaq MarketSite in New York on April 17, 2025.

The event, themed “The Nigeria Investment Agenda: Pathways for Growth & Global Partnerships,” was organized in collaboration with NGX Group, J.P. Morgan, and AVCA. It brought together representatives from top global financial institutions, including Citi, JPMorgan Chase, Standard Chartered, and Jadara Capital Partners.

Progress Acknowledged, But Oil Volatility Still a Key Risk

Investors broadly welcomed Nigeria’s reforms particularly the removal of fuel subsidies and foreign exchange (FX) liberalisation—as steps in the right direction. However, they cautioned that Nigeria’s continued reliance on oil exports poses macroeconomic fragility.

Joyce Chang, Chair of Global Research at JPMorgan Chase, said that while Nigeria has addressed some long-standing issues, the current global economic climate including new U.S. tariffs and rising recession risks—raises fresh concerns. She noted JPMorgan’s recession probability for the U.S. has jumped to 60%, warning that a drop in oil prices to the $50s range by 2026 could severely test Nigeria’s economic resilience.

Not all participants saw oil risks as a barrier to optimism. Razia Khan, Chief Economist for Africa and the Middle East at Standard Chartered, argued that Nigeria’s foreign exchange reforms are finally setting the country on a path toward diversification.

“Nigeria is finally at a point where it might be able to break free from the oil cycle,” she said.

She urged policymakers to remain committed to structural reforms, adding that macroeconomic stability and investor confidence would only be secured with consistency in monetary policy and transparent market practices.

Jason Rekate, Global Co-Head of Corporate Banking at Citi, noted a marked shift in global investor sentiment toward Nigeria.

“It’s a different conversation now. Nigeria is no longer on the ‘penalty box’ list,” he stated.

He credited the FX market liberalisation for this improvement but warned that a global recession could still expose vulnerabilities, especially with the naira.

Transaction Costs and Regulatory Barriers Still a Concern

Ahmad Zuaiter, Co-Founder and CIO of Jadara Capital Partners, highlighted Nigeria’s high transaction costs and regulatory frictions as lingering obstacles. While acknowledging progress in capital accessibility, he noted that transaction fees for listed equities in Nigeria range between 2% to 3%, compared to less than 0.2% in markets like Egypt and Saudi Arabia.

Zuaiter also urged for regulatory clarity, saying:

“Capital controls and circuit breakers have been used too often in the past. Investors need credible signals that those days are over.”

Nigeria’s Long-Term Potential Remains Strong

Despite the concerns, panellists remained optimistic about Nigeria’s long-term investment outlook. With a growing population and the potential to become the third most populous country by 2050, Nigeria offers significant market scale.

Razia Khan emphasized that investors are still underexposed to Nigeria, despite its emerging market potential, while Joyce Chang confirmed that Nigeria remains a top emerging market recommendation for JPMorgan.

Key Investor Requests to the CBN

Foreign investors listed several priority areas they believe are essential for boosting long-term confidence:

- FX policy consistency with no arbitrary restrictions or market shutdowns

- Lower transaction costs and elimination of outdated levies

- Non-oil revenue reforms, particularly in VAT and tax administration

- Ease of doing business improvements, especially for infrastructure and logistics

- Transparent monetary and fiscal policy communication

Since June 2023, under the leadership of President Bola Tinubu, Nigeria has moved to unify its exchange rate systems, liberalise the FX market, and eliminate fuel subsidies. These reforms led to significant naira volatility, but a series of monetary tightening measures helped stabilise the currency by early 2025.

However, in April 2025, the naira came under renewed pressure due to former U.S. President Donald Trump’s new tariffs, which triggered risk-aversion across emerging markets. The CBN responded by injecting liquidity into the FX market and clarified that net external reserves now stand at $23 billion.

The CBN’s investor roadshow in New York was aimed at strengthening ties with international financial institutions and reinforcing Nigeria’s message of reform-driven resilience and investment readiness.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.