The historic $2.4 billion acquisition of Shell Petroleum Development Company of Nigeria (SPDC) by Renaissance Africa Energy Holdings has been completed. The deal was completed following the grant of approval by the regulatory bodies, representing a major turning point in Nigeria’s energy industry. Renaissance Africa Energy Company Limited will now be the new name for what was formerly Shell Petroleum Development Company (SPDC) Limited.

The acquisition means that Shell has joined a host of big Western energy corporations who have pulled out from Nigeria, and marks the end of the company’s almost century-long involvement in Nigerian onshore oil and gas.

Some other notable Western oil companies that have pulled out from Nigeria in recent years include Exxon Mobil, Italy’s Eni, and Norway’s Equinor.

9am News Nigeria recounts that the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) halted Shell’s move to sell-off to Renaissance in October 2024. The Renaissance deal was blocked by the Federal Government for failing to prove that it could adequately manage the assets, which include an estimated 56.27 trillion cubic feet of gas and 6.73 billion barrels of oil and condensate.

However, Shell revealed in December 2024 that Nigeria’s Minister of Oil Resources had given his consent for Shell to sell $2.4 billion worth of onshore and shallow-water assets to Renaissance Group.

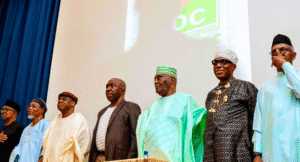

Renaissance’s CEO and managing director, Tony Attah, said he was proud to have completed the strategic acquisition on Thursday, March 13.

“The Renaissance vision is to be Africa’s leading oil and gas company, enabling energy security and industrialization in a sustainable manner. We are pleased that the Federal Government has given the green light for this milestone acquisition, in line with the provisions of the Petroleum Industry Act.”

Attah also extended gratitude to the Honorable Minister of Petroleum and other key stakeholders.

“We offer our gratitude to the Honourable Minister of Petroleum Resources, the CEO of the Nigeria Upstream Petroleum Regulatory Commission (NUPRC), and the Group CEO of the Nigeria National Petroleum Company Limited (NNPCL) and other stakeholders.”

He praised them for their vision and assistance in making the deal possible, which is anticipated to spur industrial expansion and hasten the development of Nigeria’s oil and gas resources.

Additional Information

The combined assets of Renaissance’s partner firms surpass $3 billion. The firm now produces about 100,000 barrels of oil per day from 12 oil mining leases. The consortium also runs two modular refineries in the Niger Delta, demonstrating its ability to provide innovation and value in the energy industry.

The consortium behind Renaissance includes Petrolin, an international energy company with a strong global trading presence and a pan-African vision, as well as four prominent independent oil and gas companies in Nigeria: ND Western Limited, Aradel Holdings Plc, FIRST Exploration and Petroleum Development Company Limited, and the Waltersmith Group. These partners collectively have a wealth of operational experience in the Niger Delta in addition to their common dedication to sustainable energy development.

Stay tuned to 9am News Nigeria for more Breaking News, Business News, Sports updates And Entertainment Gists.